Tales From the Crypto Crypt: 38% of Investors Have Lost More Money Than Made It

The FTX implosion, the ongoing saga of Sam Bankman-Fried and other crypto crises have kept the digital currency in the news. Behind the headlines, though, individual holders of cryptocurrency are feeling the sting.

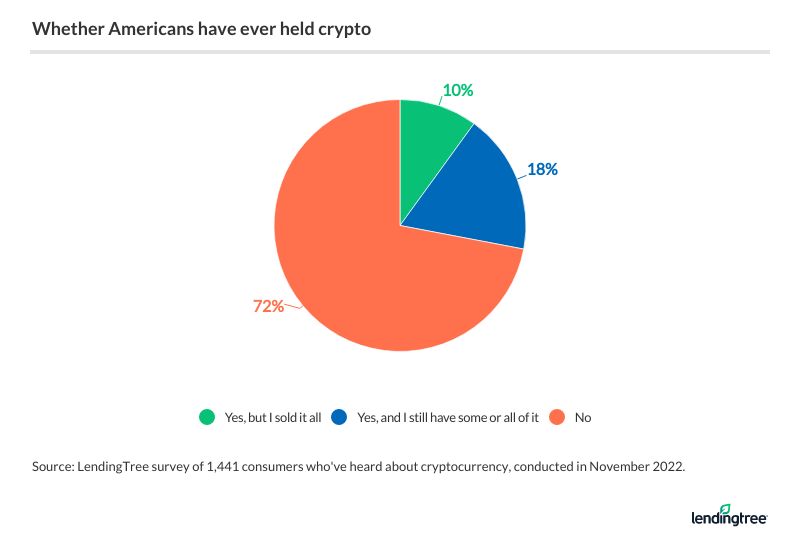

Of the 28% of Americans who’ve held some form of crypto, according to the latest LendingTree survey of more than 1,400 consumers, most (38%) have sold it for less than it was worth when they purchased it.

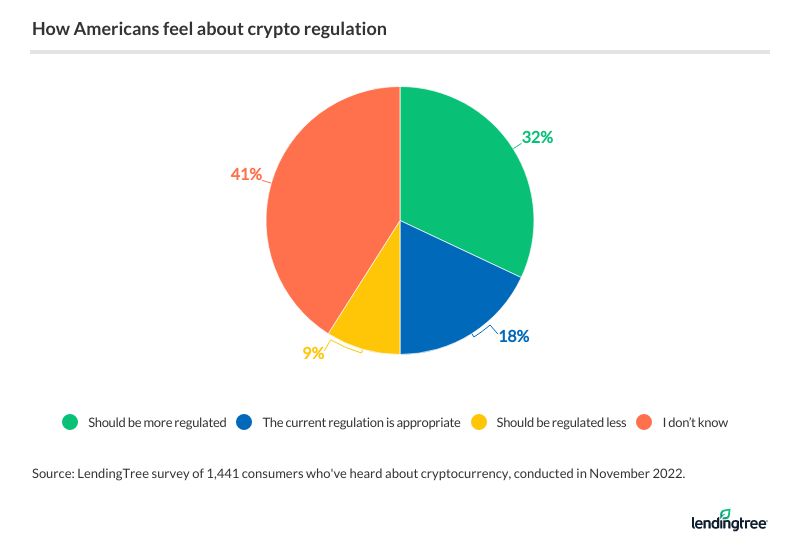

Could more regulation help ease the unease around crypto? Our survey finds 32% of respondents believe crypto should face more regulation. Read on for more about Americans’ crypto fears and projections for its future.

On this page

Key findings

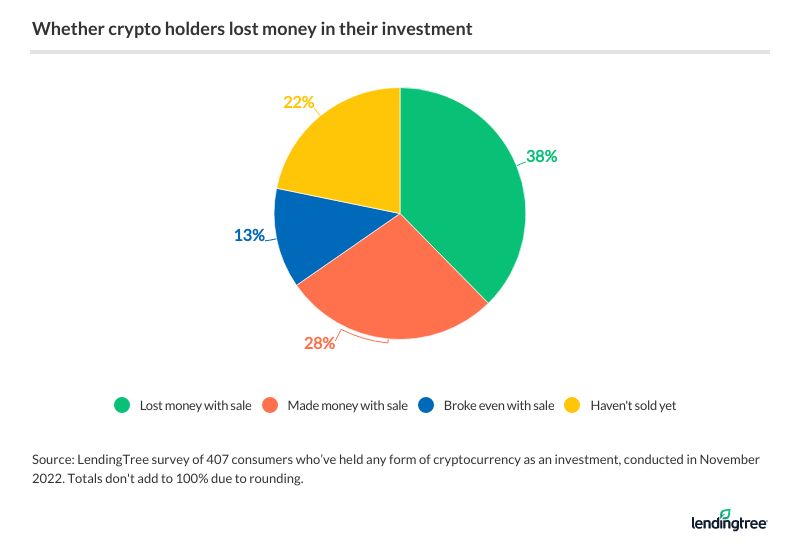

- A higher percentage of cryptocurrency investors have lost money than made it. 38% of Americans who’ve held a form of the currency say they’ve sold it for less than when they bought it, versus 28% who say they made a profit. Only 13% say they broke even.

- Failed exchange FTX has kept crypto in the news, but only 28% of Americans have held some form of crypto. After removing the top and bottom 1% of survey respondents, the average amount invested in crypto is $7,738, with a median of $500.

- The crypto hype isn’t just for those with cash to spare, as almost 1 in 5 investors (19%) have borrowed money to get a stake in the digital currency. While this might be surprising, taking on debt to invest isn’t new, as a 2021 MagnifyMoney survey found that 40% of investors have done so.

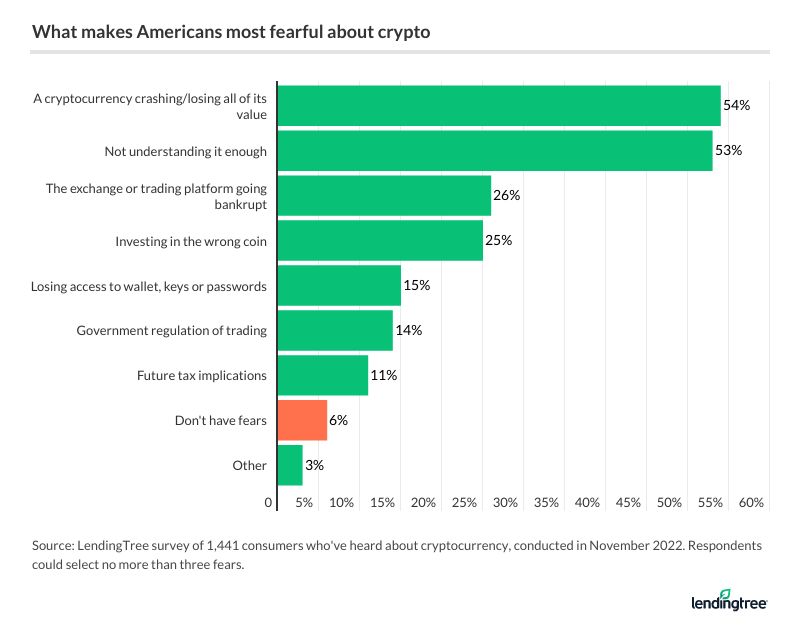

- Respondents’ top crypto fear is losing all its value. This may explain why Americans are split 50-50 on whether they believe the currency will be a popular investment in the next five years. Additionally, 26% of Americans fear their crypto trading platforms going bankrupt. (FTX filed for bankruptcy days before this survey was fielded in mid-November.)

- To improve consumers’ faith in crypto as an asset, 32% of Americans believe it should be more regulated. When asked to choose among the stock market, the government and crypto, 76% of respondents chose either the stock market or government as the most trustworthy, leaving crypto with a lot of ground to make up.

Losing more money than you make

It’s not that no one has made money off crypto. In fact, our survey finds that of those who’ve had crypto, 28% sold it for more than it was worth. But a higher rate of investors — 38% — sold their crypto for less than it was worth when they bought it. Another 13% broke even.

LendingTree chief credit analyst Matt Schulz says losing money like this on crypto investments — or losing big on any investments, for that matter — can have serious implications on your finances.

“It can make you feel less secure about your own financial stability, both in the short term and the longer term,” he says. “It impacts how much financial risk you’re willing to take in other areas of your life. It’s a big deal, especially for those whose financial margin for error isn’t huge.”

Crypto’s prominent in the news, but there aren’t many investors

They say no news is good news. But that’s bad news for crypto, which has grabbed more than its fair share of headlines lately … and not for positive reasons.

To name a few from the first week of 2023 alone:

- U.S. regulators issued a warning about crypto to banks, highlighting a slew of risks from fraud and scams to misleading representations.

- Crypto lender Celsius Networks was slapped with a civil lawsuit for allegedly defrauding droves of investors out of billions of dollars.

- Crypto exchange Binance is under federal fire for potential money-laundering issues.

- Major crypto exchange Coinbase reached a settlement in which it must pay $100 million for compliance issues.

And this is all on the 2022 heels of the FTX collapse and the ongoing saga of its founder, Sam Bankman-Fried, who faces up to 115 years in prison after an eight-count indictment on charges ranging from fraud to money laundering.

For all the hoopla (or perhaps because of it?), few Americans own crypto, though. Our survey finds 72% of Americans have never held any form of crypto, while 10% have had some but sold it. Only 18% currently hold crypto investments.

Here’s a breakdown looking at various demographics:

- Men are more than twice as likely as women to currently have crypto investments — 25% versus 11%, respectively.

- Younger generations are more likely to own it than older generations. Millennials ages 26 to 41 are the most likely to currently own crypto (27%), followed by Gen Zers ages 18 to 25 (18%) and Gen Xers ages 42 to 56 (17%). Only 6% of baby boomers ages 57 to 76 own crypto.

- Those with children younger than 18 are more likely to currently own crypto than those without children — 26% versus 17%, respectively. Both are more likely to own it than those whose children are 18 and older (11%).

- The higher one’s household income, the more likely they are to own crypto. For example, 25% of those who make $100,000 or more annually own crypto, versus 14% of those who make less than $35,000.

There may be different reasons for this crypto caution. For one thing, it’s a relatively new form of investment. The first form of crypto — bitcoin — was mined just 14 years ago this month, while the origins of the U.S. stock market date back to the 1700s. Pair that with a plethora of fraud reports and a general lack of understanding about crypto and it’s easy to see why many people aren’t diving in head or wallet first.

Schulz says there’s an old saying in investing that you shouldn’t invest in anything you don’t understand. And, generally, that’s good advice.

“Yes, it can be really, really tempting when you hear tales about people getting crazy-rich off an investment, and your TV is littered with ads starring big Hollywood movie stars telling you to invest in something,” he says. “However, it’s absolutely essential to take your time to research what you’re investing in, whether it’s an index fund, a dividend stock or bitcoin. You don’t have to know every single last thing about it, but the more you understand about what you’re investing in, the more informed a decision you can make. That’s important when it comes to investing. While success is never guaranteed, what you don’t know really can come back to hurt you.”

How much money respondents have invested in crypto

Some who’ve braved the crypto waters have dove deep. After removing the top and bottom 1% of survey respondents, the average amount invested in crypto — according to our research — is $7,738, with a median of $500.

Many people have a set amount of money they’re able and/or willing to invest. In some cases, that may mean having to decide how much they’re willing to divert from other investments for a potential crypto payoff. Our survey finds 14% of people who’ve invested in crypto put in $10,000 or more, while 76% have dipped their toes in with less than $5,000. The final 10% waded in with investments in between.

Others may not necessarily have the cash to invest but do so anyway. Almost 1 in 5 investors (19%) say they’ve borrowed money to buy crypto. Married people are more likely to borrow to buy crypto than those who have never married — 22% versus 16%.

Borrowing to invest isn’t unique to crypto, though, as a 2021 MagnifyMoney survey found that 40% of investors have borrowed money to invest in general. While there’s potential for payoff, and you can’t win if you’re not in, it’s a risky business at best. It’s especially risky if you have other debt.

“With any investment, and perhaps especially with crypto, you must, must, must understand your own tolerance for risk,” Schulz says. “While some people are totally comfortable investing in something that may fluctuate wildly on a regular basis, others would be terrified by that. Neither view is wrong. It’s just a matter of your preference and your goals. However, only you can make those determinations about yourself, so be sure to think about your own risk tolerance before you invest.”

No surprise: Bitcoin most commonly known crypto

Some cryptos have more name recognition clout than others, and the one most people know is bitcoin, with 93% of respondents saying they’ve heard of it. Recognition rates drop sharply from there, though, with less than 50% of respondents recognizing any of the others on the list, including dogecoin (38%), ethereum (36%) and U.S. digital coin (24%).

As for where they’ve heard about crypto, social media leads the way, with 48% of respondents getting information there. This is followed by friends and family (46%) and news publications (44%.) Schulz says it’s vital that people understand their investments.

“People make bad decisions when they don’t understand what they’re getting into,” he says. “That’s true in many aspects of life, and money is certainly no exception. If you do want to test the waters with crypto, do your homework and consider starting small. That way, if worse comes to worse, your losses won’t be devastating.”

What makes consumers most fearful about crypto

It’s clear there are crypto fears. Not surprisingly, respondents’ biggest fear is a crypto crash in which the currency loses all value (54%). That’s followed by a fear of not understanding it enough (53%) and the exchange or trading platform going bankrupt (26%). Another crypto lender, Genesis, filed for bankruptcy on Jan. 19, 2023, citing more than 100,000 creditors in its filing.

Only 6% say they have no fear of crypto at all.

“People are fearful of crypto for many reasons,” Schulz says. “It’s relatively new. It’s confusing. It’s complex. And anytime there is great risk involved, it’s wise to proceed with great caution.”

The future of crypto remains to be seen, and people are split 50-50 on whether it will be/stay a popular investment in the next five years. It’s the older generations who have the least faith in crypto, with 69% of baby boomers stating they believe it won’t be/stay a popular investment in the next five years, followed by 50% of Gen Xers, 42% of Gen Zers and 41% of millennials.

Should crypto be regulated more?

With all the crypt crises, crypto regulation is a hot topic, and investors are on the edge of their seats waiting to see how the playing field may (or may not) change. With a narrow margin between the number of Democrats and Republicans in Congress, new legislation is anything but a certainty. Will the Securities and Exchange Commission (SEC) step in? Perhaps, but one thing is clear: 2023 will be a pivotal year for crypto regulations.

Do Americans think crypto should be more regulated? Our survey finds most (41%) are unsure, while 32% believe it should be more regulated. Only 9% believe crypto should be less regulated, while 18% think the current level of regulation is appropriate.

Whether more regulation will be enforced and whether it’ll quell inventors’ fears remains to be seen, but crypto has its work cut out for gaining people’s trust. When asked to choose the most trustworthy among the stock market, the government and crypto, 76% of respondents chose either the stock market or government.

| 1 | 2 | 3 | |

|---|---|---|---|

| Crypto | 24% | 31% | 45% |

| Stock market | 45% | 43% | 12% |

| Government | 31% | 26% | 43% |

Source: LendingTree survey of 1,441 consumers who’ve heard about cryptocurrency, conducted in November 2022.

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 1,441 U.S. consumers ages 18 to 76 who’ve heard about cryptocurrency from Nov. 15 to 21, 2022. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2022:

- Generation Z: 18 to 25

- Millennial: 26 to 41

- Generation X: 42 to 56

- Baby boomer: 57 to 76